The long-awaited amendment to FINRA’s Rule 4210 (Margin Requirements) comes into effect 22 May 2024, impacting all Covered Agency Transactions.

Amendment summary

FINRA 4210 is a rule specific to registered broker dealers, outlining the minimum margin requirements they need to maintain in their clients' accounts for specific transactions.

The new amendment focuses on Covered Agency Transactions. Firms will now need to margin this activity daily or be subject to capital charges on the unsecured exposures.

The transaction types impacted:

- To Be Announced (TBA) transactions inclusive of Adjustable Rate Mortgages (ARM), with settlement dates later than T+1

- Specified Pool Transactions with settlement dates later than T+1

- Agency Collateralized Mortgage Obligations (CMOs) with settlement dates later than T+3.

Impact on collateral functions

Alongside increased funding requirements firms will experience a range of significant operational workflow impacts, including an uptick in margin call, settlement volumes and cash collateral interest processing.

Collateral systems will need to accommodate:

- MSFTA (Master Securities Forward Transaction Agreements) legal agreement digitization

- Net Mark to Market (MTM) calculation

- Securities collateral pricing

- Margin call calculation and agreement

- Optimized asset selection

- Interest calculation, agreement and settlement

- Customized reporting.

Are you ready for FINRA 4210?

With the impending 22 May deadline, firms may still be considering how to comply.

Dealers can opt to incur capital charges instead of collecting margin under the amendment, however firms shouldn’t consider this option lightly. Increased capital charges will be a drag on balance sheets, directly impacting financial performance.

Firms need to assess their operational infrastructures and determine whether they’re ready to absorb the additional margin call and settlement volumes. This analysis must consider periods of increased market volatility, a trend expected to be sustained given the continued geopolitical uncertainty and sustained rate increases.

With cost bases high and budgets limited across the market, firms are unlikely to scale up and manage their FINRA 4210 requirements using a traditional manual process, without credit and operational risks. Robust and automated processes are a necessity to reduce capital charges and drive down operational costs.

“ Legacy technology which requires patching and upgrading has to be a nightmare we all consign to the past.”

Resilience and cost efficiency

Firms using automated, STP workflows are benefiting from minimized operational costs and risks. Limited resources are freed up to focus on exception management, rather than manual, complex processes. Increased resilience is also an outcome, as automation future-proofs their ability to seamlessly manage periods of increased margin call volumes.

Leveraging a collateral workflow solution like CloudMargin, firms can automate MSFTA margining within weeks. Margin calls are calculated by the system through centrally sourced market data and automatically sent to counterparties electronically through STP. By setting risk tolerances and thresholds, the system agrees margin calls automatically, whilst collateral is pledged by the system according to flexible agreement level asset selection criteria. Firms can instruct settlement through customized feeds into their existing process or via CloudMargin’s Swift gateway.

Solve tactically or make a strategic change

CloudMargin is helping clients get ready for FINRA 4210, ensuring straightforward, time-efficient and low-cost compliance with their Covered Agency Transactions collateral requirements. Clients can solve for the amendment either as a tactical, stand-alone solution or as a broader strategic change to future-proof their collateral workflows.

- Clients who’ve chosen a tactical, stand-alone approach in managing their MSFTA agreements are getting in front of the regulation as their key focus, easing any potential strain on their operations teams using CloudMargin technology

- Other clients are adopting a strategic approach, managing MSFTAs in CloudMargin alongside their broader collateral obligations, including OTC bilateral, Repo, ETD, Cleared OTC and PB. By future-proofing their collateral management workflows through an enterprise-wide automated margin process, they’re benefiting from real-time transparency of their exposures, assets and holdings across all traded asset classes.

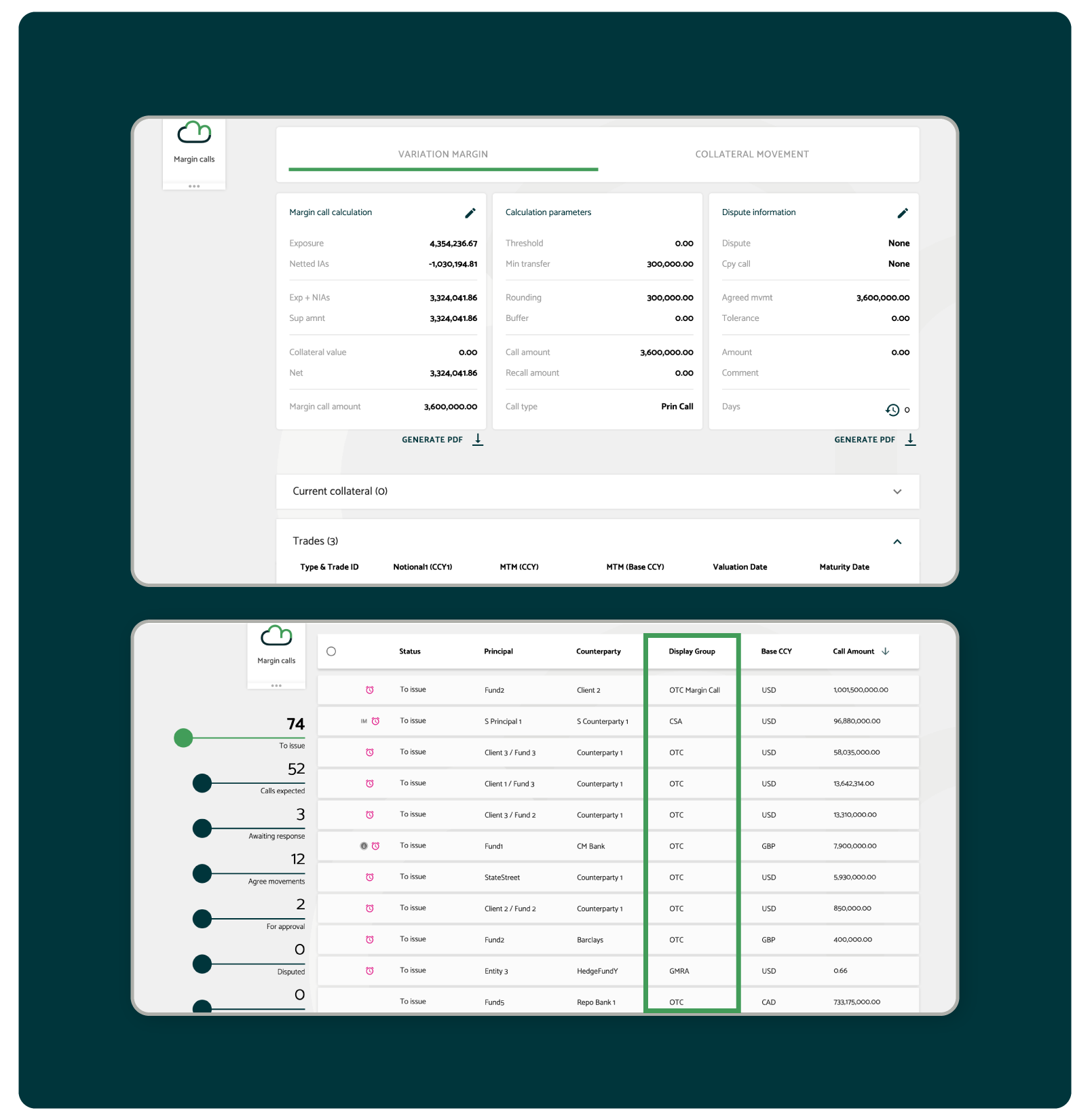

The margin call examples below demonstrate how clients see a real-time view of their counterparty trades, exposure, collateral position, and the calculation parameters using CloudMargin technology.

Whichever approach firms choose to meet their FINRA 4210 obligations, robust and automated processes are essential in reducing their volume concerns, decreasing capital charges for regulated dealers and ultimately driving down operational costs.

“ Regulation must come first as regulatory compliance is non-negotiable. However, what’s important is to build out and meet the regulation in the context of a firm’s broader overall strategy and vision. Successful regulatory compliance and innovation in collateral management are by no means mutually exclusive.”

David White, Chief Commercial Officer CloudMargin

There’s still time to get ready for FINRA 4210

There’s still time for firms to avoid capital charges and drive down operational costs, whilst meeting their FINRA 4210 obligations. Moving quickly to automated workflows through a web-based, SaaS solution like CloudMargin, firms can be up and running in weeks to achieve their 22 May deadline.